Using Health Insurance for Mental Health & Addiction Treatment:

A Full Guide

The Haven Detox works with most major insurance companies on a daily basis to cover both inpatient and outpatient addiction and mental health treatment. Most patients here use insurance to cover the majority (and sometimes all) of the costs of treatment.

4.9

Most Common Health Insurances Used Here

Most insurance plans include coverage for both mental health and substance use care. If you recognize your insurance provider below, it’s likely inpatient or outpatient treatment is covered at The Haven Detox.

| Parent Brand | Specific Health Insurers |

| Aetna Health Insurance |

| AmeriHealth Administrators |

| Anthem Blue Cross Blue Shield Colorado, Anthem Blue Cross Blue Shield Kentucky, Anthem Blue Cross Blue Shield Missouri, Blue Cross Blue Shield, Blue Cross Blue Shield Arizona, Blue Cross Blue Shield Arkansas, Blue Cross Blue Shield Capital, Blue Cross Blue Shield Excellus, Blue Cross Blue Shield Federal Employee Program, Blue Cross Blue Shield Georgia, Blue Cross Blue Shield Indiana, Blue Cross Blue Shield Massachusetts, Blue Cross Blue Shield Maryland, Blue Cross Blue Shield Maine, Blue Cross Blue Shield New Jersey, Blue Cross Blue Shield New York, Blue Cross Blue Shield Rhode Island, Blue Cross Blue Shield Texas, Blue Cross Blue Shield Virginia, CareFirst Blue Cross Blue Shield, Empire Blue Cross Blue Shield, Health Advantage, Highmark Blue Cross Blue Shield, Wellmark Blue Cross Blue Shield Massachusetts |

| Ambetter, WellCare, Fidelis Care |

| Government Employees Health Association (GEHA) |

| Harvard Pilgrim Health Care |

| Humana / Humana Military |

| MAP – Modern Assistance Programs |

| Arkansas Medicaid / PASSE Empower, MassHealth, Molina Healthcare, WellSense New Hampshire Medicaid, Indiana Medicaid (Hoosier Healthwise, Hoosier Care Connect, Healthy Indiana Plan (HIP)), New York Medicaid (MVP / Fidelis / WellCare), Arizona Medicaid (AHCCCS), Arizona Complete Health, New Hampshire Medicaid (WellSense) |

| WellSense Medicare Advantage HMO, Humana Medicare Advantage, Blue Cross Blue Shield Medicare Advantage, Aetna Medicare Advantage, UnitedHealthcare Medicare Advantage, WellCare Medicare Advantage |

| Oxford Health Plans |

| Surest (formerly Bind) |

| Tricare, Tricare East (PGBA), TriWest |

| Tufts Associated Health Plans, Tufts Health Plan |

| UnitedHealthcare / UHC |

| Wellpoint (formerly Anthem) |

| MVP Health Plan of New York, HealthPartners Minnesota |

Parent Brand

- Aetna (CVS Health)

Specific Health Insurers

Aetna Health Insurance

Parent Brand

- Aetna (CVS Health)

Specific Health Insurers

Aetna Health Insurance

Parent Brand

- Anthem / Blue Cross Blue Shield

Specific Health Insurers

Anthem Blue Cross Blue Shield Colorado, Anthem Blue Cross Blue Shield Kentucky, Anthem Blue Cross Blue Shield Missouri, Blue Cross Blue Shield, Blue Cross Blue Shield Arizona, Blue Cross Blue Shield Arkansas, Blue Cross Blue Shield Capital, Blue Cross Blue Shield Excellus, Blue Cross Blue Shield Federal Employee Program, Blue Cross Blue Shield Georgia, Blue Cross Blue Shield Indiana, Blue Cross Blue Shield Massachusetts, Blue Cross Blue Shield Maryland, Blue Cross Blue Shield Maine, Blue Cross Blue Shield New Jersey, Blue Cross Blue Shield New York, Blue Cross Blue Shield Rhode Island, Blue Cross Blue Shield Texas, Blue Cross Blue Shield Virginia, CareFirst Blue Cross Blue Shield, Empire Blue Cross Blue Shield, Health Advantage, Highmark Blue Cross Blue Shield, Wellmark Blue Cross Blue Shield Massachusetts

Parent Brand

- Centene Corporation

Specific Health Insurers

Ambetter, WellCare, Fidelis Care

Parent Brand

- GEHA

Specific Health Insurers

Government Employees Health Association (GEHA)

Parent Brand

- Harvard Pilgrim

Specific Health Insurers

Harvard Pilgrim Health Care

Parent Brand

- Humana

Specific Health Insurers

Humana / Humana Military

Parent Brand

- Modern Assist Healthcare

Specific Health Insurers

MAP – Modern Assistance Programs

Parent Brand

- Medicaid

Specific Health Insurers

Arkansas Medicaid / PASSE Empower, MassHealth, Molina Healthcare, WellSense New Hampshire Medicaid, Indiana Medicaid (Hoosier Healthwise, Hoosier Care Connect, Healthy Indiana Plan (HIP)), New York Medicaid (MVP / Fidelis / WellCare), Arizona Medicaid (AHCCCS), Arizona Complete Health, New Hampshire Medicaid (WellSense)

Parent Brand

- Medicare Advantage

Specific Health Insurers

WellSense Medicare Advantage HMO, Humana Medicare Advantage, Blue Cross Blue Shield Medicare Advantage, Aetna Medicare Advantage, UnitedHealthcare Medicare Advantage, WellCare Medicare Advantage

Parent Brand

- Oxford Health Plans

Specific Health Insurers

Oxford Health Plans

Parent Brand

- Surest

Specific Health Insurers

Surest (formerly Bind)

Parent Brand

- Tricare

Specific Health Insurers

Tricare, Tricare East (PGBA), TriWest

Parent Brand

- Tufts

Specific Health Insurers

Tufts Associated Health Plans, Tufts Health Plan

Parent Brand

- United Healthcare

Specific Health Insurers

UnitedHealthcare / UHC

Parent Brand

- Wellpoint

Specific Health Insurers

Wellpoint (formerly Anthem)

Parent Brand

- Various Regional Health Plans

Specific Health Insurers

MVP Health Plan of New York, HealthPartners Minnesota

Behavioral Health Carve-Outs

If you notice a different company name listed on your insurance card for mental health or addiction service, that’s a behavioral health carve-out. It means this company handles prior authorizations, claims, and in/out of network, and is usually listed on your insurance card.

- Optum Behavioral Health (UnitedHealth Group owned, formerly UBH/UHC): Behavioral health administrator for many major carriers, especially United Healthcare.

- Carelon Behavioral Health (formerly Beacon Health Options): Administers behavioral health benefits for insurers and self-funded plans.

- Magellan Health: Behavioral health administrator for large employer and insurance networks.

- Medica Behavioral Health: Regional health plan/administrator that manages behavioral health benefits.

- Evernorth Behavioral Health (Cigna owned): Oversees mental health and substance-use services for Cigna and other affiliated plans.

Third-Party Administrators (TPAs)

A Third-Party Administrator (TPA) isn’t an insurance company but a contracted organization that handles claims processing, benefit verification, network management, and member support for self-funded employer plans.

- AmeriHealth: TPA arm for self-funded employer plans.

- Optum (UnitedHealth Group): Functions as a TPA and behavioral health manager.

- Modern Assist Healthcare: Independent TPA and benefits administrator.

- PGBA: Palmetto Government Benefits Administrator for Tricare East region.

- UMR: UnitedHealthcare’s TPA for self-funded employer plans.

- Meritain Health: Aetna’s TPA arm for self-funded employers.

- Lucent Health: Independent TPA for self-funded employer plans.

- Auxiant: Regional TPA for self-funded employer plans.

- Imagine360: TPA that manages self-funded employer plans (listed with Florida).

NOTE: A self-funded (or self-insured) plan is a type of health coverage in which the employer — not an insurance company — pays for employees’ healthcare costs directly.

Union and Benefit Funds

A union/benefit fund is also not insurance, but a trust that sets the benefits and pays claims with employer contributions. It commonly hires a TPA. On your ID card or benefits info you usually see the fund name.

- IUOE Local 99 Benefit Fund

- Teamster Union Health

EAP (Employee Assistance Program)

Employer-paid short-term counseling (3–10 sessions) that does not cover detox or residential care, outpatient programs, or additional sessions.

Yes, Insurance Covers Treatment Here

Most insurance policies cover treatment here so any cost to you is as low as possible — sometimes even zero. No one will be notified if you inquire. And, there’s no commitment.

Many More

Your information will be kept private

Insurance Glossary To Better Understand Detox, Rehab & Mental Health Insurance

Understanding Your Plan Type

The type of plan you have determines which treatment centers you are able to access and can also impact the paperwork and costs.

HMO vs. PPO

HMO (Health Maintenance Organization)

- Must use in-network providers (except emergencies).

- Referrals often required.

- More predictable and usually lower costs.

- Pre-authorizations can get denied or delay care.

- Limited to only in-network facilities, which can be a challenge for you to find good care. Insurers sometimes pay way to low or close off their network and you miss out on top providers.

PPO (Preferred Provider Organization)

- Freedom to see in-network or out-of-network providers without a referral.

- Usually lower cost when staying in-network.

- Best for specialized or even out-of-state programs like detox and residential.

Less Common Plan Types

POS (Point of Service)

Works like an HMO but out-of-network allowed with a referral from your primary care provider.

EPO (Exclusive Provider Organization)

Works like an HMO but without referrals.

Useful Plan Features

- HDHP / HSA (High-Deductible Health Plan with Savings Account): Higher deductible before benefits start, but lower monthly premiums and HSA funds can be used pre-tax.

- Fully Insured vs. Self-Funded (ASO): Even if your card says Aetna or Cigna, rules may differ if the employer (not the insurance) controls coverage:

- Fully insured: Insurance company sets benefits and pays claims.

- Self-funded: Employer or union fund pays claims and hires a TPA (Third-Party Administrator).

- Marketplace / Exchange Plan: Plan purchased on Healthcare.gov or your state’s marketplace. These policies must include mental health and substance-use benefits, but tend to pay low rates to the facility, so finding an in-network provider as required can be more difficult.

- Medicaid / Medicaid Managed Care (MCO): Joint state and federal program, often managed by companies like WellSense, Molina, or Anthem to cover mental health and addiction services. Though, network and preauthorization vary by state. Ask about the full plan name (e.g., “WellSense NH Medicaid”), not just “Medicaid.”

- Medicare & Medicare Advantage: Medicare rarely covers residential treatment for mental health or substance use. Confirm in-network status on Advantage plans because a provider can be in-network with Cigna, but not Cigna Advantage plans.

- Medicare: Traditional federal plan (Parts A/B). Fewer covered residential or rehab options.

- Medicare Advantage (Part C): Private replacement plan with set networks and prior authorization rules.

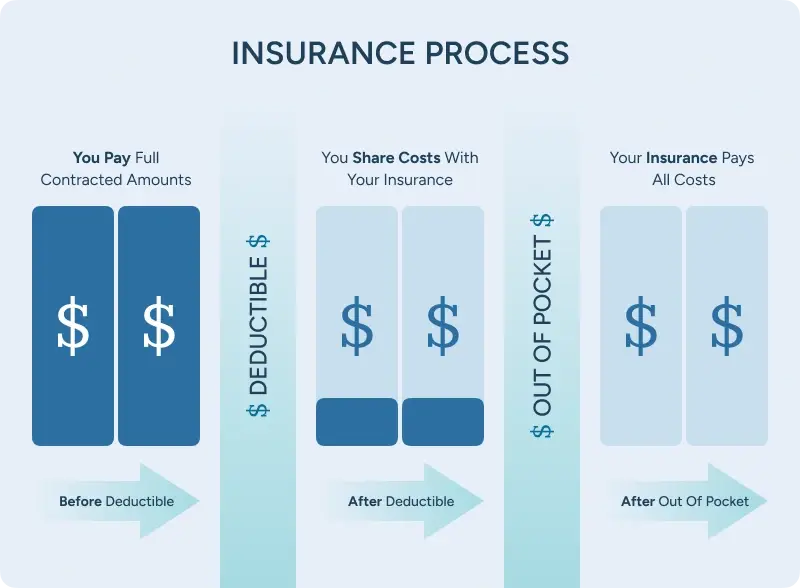

Cost Terms Explained

Insurance companies use a lot of terminology that needs to be fully understood to be able to calculate your costs. The treatment center can explain how this works for your plan and translate all costs and rates into an estimate.

- Deductible: The amount you must pay each year in eligible medical costs before insurance begins covering any part of your health care. Deductibles reset every year.

- Copay: Flat dollar amount you pay for a specific visit or service, which can be instead of or on top of coinsurance.

- Coinsurance: Once you’ve paid your deductible, your plan may still require you to share costs with coinsurance until you reach your out-of-pocket maximum (e.g., 20% you / 80% plan). Some plans have no co-insurance stage.

- Out-of-Pocket Maximum: After you out-of-pocket-maxium, the plan covers 100% of eligible healthcare costs for the rest of the plan year.

If you’ve already paid for medical costs earlier in the year (especially a hospitalization), there may be no cost to you for addiction or mental health treatment even for inpatient detox or psychiatric hospitalization.

Health Insurance Billing

- Premium: Monthly payment to keep your insurance active.

- Allowed Amount: What your plan agrees to pay the doctor or treatment center for a service.

- EOB (Explanation of Benefits): Not a bill, but shows what your insurance paid and what you may owe. Adjustments can still happen. Any actual bill will come from the treatment center, not the insurance company.

- Itemized Statement: Provider’s detailed billing list; needed for HSA/FSA reimbursements.

- Good Faith Estimate: Required cost estimate for self-pay patients.

- No Surprises Act: Protects against unexpected out-of-network bills in emergency or certain in-network settings.

Reading Your ID Card

- ID & Group Numbers: Always provide both (front and back photos are even better).

- Network Name/Logo: Indicates which providers are in-network.

- Behavioral Health Number: Often a separate phone line from medical.

- Pharmacy Info: BIN, PCN, and group numbers identify your prescription network, which determines if a medication is covered and the cost.

Requirements For Addiction Treatment & Mental Health Treatment Centers

Insurance companies look for specific standards to be eligible to cover care. These requirements are designed to ensure the facility provides safe, evidence-based, and high-quality care.

Not every treatment center meets these standards. Facilities that lack proper licensing, accreditation, or network agreements may not qualify for coverage, so you’d be responsible for the full costs.

- National Accreditation

Behavioral health facilities usually need to to be nationally accredited for coverage, adhering to national standards for safety, quality, and clinical care. The two most common accreditations insurances looks for are:

- The Joint Commission (TJC)

- CARF (Commission on Accreditation of Rehabilitation Facilities)

- State Licensure

In addition to national accreditation, facilities must also maintain a valid state license appropriate to the level of care offered (e.g., residential substance use treatment, psychiatric hospital).

- Network Contracting

Even if a facility is licensed and accredited, it must also have a contract with the insurance company to be considered in-network. Out-of-network facilities may still receive reimbursement under some PPO plans, but the patient’s out-of-pocket costs may be higher.

- Prior Authorizations

Prior authorization is when your insurance company requires approval before you start certain treatments or services to confirm they’re medically necessary. Care can be delayed or denied without this pre-authorization, but the treatment center should handle any paperwork and follow-ups.

The need for prior authorization upfront and to remain inpatient depend on the state and insurance company policy.

New Jersey

No prior authorization is required for substance use treatment at in-network facilities or for approved medications; the facility only needs to notify the insurance company within 48 hours. This means patients can start care right away without waiting for insurance approval. ⓘ

Massachusetts

Prior authorization is not allowed for acute mental health stabilization or crisis treatment, and insurers must post their rules publicly. This helps patients get urgent psychiatric care faster and know exactly what is covered.

Arkansas

Insurers cannot require prior authorization for most MAT medications like buprenorphine, methadone, and naltrexone. Patients can access life-saving medication more quickly and consistently. ⓘ

Arizona

State law requires fast prior authorization decisions and forces insurers to honor existing approvals for 90 days if you switch coverage. This prevents treatment from being interrupted during transitions in care. ⓘ

Florida

Under the Baker Act (psychiatric) and Marchman Act (substance use), people in crisis can be admitted for emergency care without prior authorization. Patients in urgent danger can receive immediate stabilization before any insurance review. ⓘ

Puerto Rico

Federal parity rules apply, so mental health and addiction care must be covered the same as medical treatment. Patients should expect equal coverage, but local networks and rules may differ from mainland plans. ⓘ

Finding Detox, Rehab & Mental Health Services Covered by Insurance

If you live in Arizona, Arkansas, Florida, Indiana, Massachusetts, New Jersey, New York, or Puerto Rico, we can help you directly find in-network care. Just call or text (561) 328-8627 any time. Otherwise, you can try calling the number on the back of your insurance card.

The Haven Detox - Arizona

Space Available

Insurance Accepted

The Haven Detox - Little Rock

Space Available

Insurance Accepted

The Haven Detox - New Jersey

Space Available

Insurance Accepted

The Haven Detox - West Memphis

Space Available

Insurance Accepted

The Haven Detox - Florida

Space Available

Insurance Accepted

The Haven Detox - New England

Space Available

Insurance Accepted

The Haven Detox - Puerto Rico

Space Available

Insurance Accepted

Yes, Insurance Covers Treatment Here

Most insurance policies cover treatment here so any cost to you is as low as possible — sometimes even zero. No one will be notified if you inquire. And, there’s no commitment.

Many More

Your information will be kept private

Have Questions? Let’s Talk!

Need someone to talk to? We’re always here—day or night.

Ask questions, get guidance—no pressure, no obligation.

Your story stays with us. Confidential support, always.