Cigna Insurance Coverage for Detox, Addiction & Mental Health Treatment

Cigna covers the full continuum mental health care, from medical detox and inpatient psychiatric hospitalization to residential rehab, PHP, IOP, routine outpatient therapy, and medication-assisted treatment (MAT).

Coverage decisions are based on medical necessity, clinical assessments, and ongoing progress, with most services authorized in short review periods and extended only if documentation shows continued need.

The information below generally applies to all Cigna policies including Cigna HealthCare, the Cigna + Oscar partnership, and Cigna Global, which covers nearly 20 million people in the U.S. ⓘ Behavioral health services are managed by a division recently renamed Evernorth Behavioral Health.

| Level of Care | Cigna’s Wording | Covered by Cigna |

|---|---|---|

| Medical Detox | Acute inpatient substance use detoxification (hospital or inpatient unit) | |

| Inpatient Rehab (Hospital) | Acute inpatient substance use treatment (rehab in a hospital-level setting) | |

| Residential Rehab | Residential substance use treatment (24/7, non-hospital) | |

| Partial Hospitalization (PHP) | Partial Hospitalization Program (PHP) for substance use | |

| Intensive Outpatient (IOP) | Intensive Outpatient Program (IOP) for substance use | |

| Medication-Assisted Treatment (MAT) | Medication-Assisted Treatment (MAT) for opioid or alcohol use disorders | |

| Sober Living | Not a covered benefit — Cigna specifically excludes boarding or housing tied to treatment |

1

Cigna insurance covers 24/7 monitored detox to withdrawal from alcohol, benzodiazepines, opioids, and sometimes other drugs if continuous nursing, physician oversight, and medications are needed to manage symptoms.

Cigna does not assign a preset number of detox days. Cigna requires daily review and authorizes only as long as medical severity is met. Care transitions to a lower level of care (residential, PHP or IOP) once symptoms are safely managed.

2

Cigna insurance covers psychiatric hospitalization including 24/7 hospital-based stabilization. This involves continuous monitoring by nurses and physicians, daily psychiatric evaluations, medication management, and structured therapy in a secure environment.

Cigna authorizes hospital stays in short review cycles (every few days) and continues approval only if the patient still requires round-the-clock stabilization. ⓘ Cigna stresses that coverage is based on clinical necessity, not preset averages or scheduling of the treatment program.

3

Cigna insurance covers both residential drug rehab and residential mental health treatment, which involves 24/7 structured programs with medical oversight, counseling, and supervised living in a non-hospital setting.

Cigna does not have preset program lengths. Authorization depends on documented medical necessity, proving a step-down to PHP or IOP is not yet appropriate.

4

Cigna covers PHP for both mental health and addiction. PHP involves intensive day treatment, usually 20+ hours per week across 5 days, with patients returning home or to a sober living environment at night. Cigna does not cover “boarding” often tied to PHP.

Cigna authorizes PHP in short blocks, often 5–10 days at a time. Updated clinical documentation (progress notes, functional status, and risk factors) must show ongoing need.

5

Cigna covers IOP for both substance use and mental health. IOP is defined by Cigna as structured outpatient treatment 3–4 hours per day, 3–5 days per week.

Initial approvals are generally for 7–10 treatment days (2-4 weeks), with continued coverage requiring evidence of ongoing clinical necessity (such as persistent symptoms, impaired functioning, or barriers to step-down care).

6

Cigna covers outpatient therapy & psychiatry including individual, group, or family therapy, as well as psychiatric evaluations and medication management with a licensed prescriber.

Most modern Cigna plans do not cap the number of outpatient sessions per year, though copays and cost-sharing apply. A medical necessity review may be requested if sessions are unusually frequent or prolonged.

Cigna covers outpatient MAT programs that combine FDA-approved medications (buprenorphine, methadone, naltrexone, acamprosate, disulfiram) and with counseling. A documented diagnosis of opioid or alcohol use disorder is required. Cigna follows national guidelines (SAMHSA, ASAM), which recommend MAT for months to years, and sometimes indefinitely, depending on relapse risk.

7

Halfway housing or sober living is not covered by Cigna or other health insurance companies.

Even when Cigna covers a service, you may still pay your plan’s deductible and copays/coinsurance until you reach the out-of-pocket (OOP) maximum. After that, Cigna pays 100% of covered charges for the rest of the plan year.

If you’ve had a hospitalization or other intensive treatment already in the year, your OOP maximum may already be met. This applies if you’re on a family plan with someone who had extensive healthcare costs. In those cases, Cigna can fully cover inpatient detox, addiction, or mental health treatment.

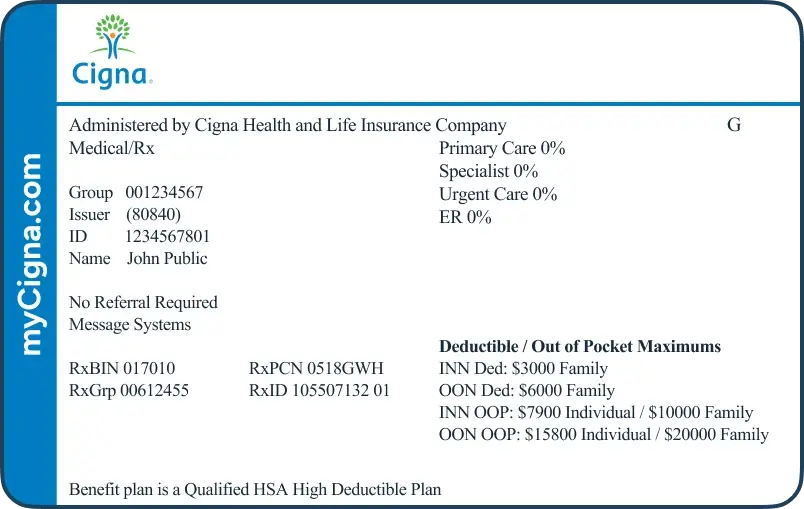

Your Cigna network is usually listed on your card. Open Access Plus gives access to Cigna’s large national network, while LocalPlus limits care to a smaller regional network. SureFit requires referral from your primary care doctor for mental healthcare.

This isn’t a separate network. It combines a traditional medical network (often OAP or PPO) with a consumer health account (like an HRA or HSA).

In many markets, Cigna allows “shared administration” arrangements where an employer or a third-party administrator (TPA) uses Cigna’s network and contracted discounts. ⓘ

The most frequent TPA we see with Cigna is Allegiance Benefits Management (which Cigna has owned since 2008), as well as 90 Degree Benefits, AmeriBen, Collective Health, Lucent Health, Meritain Health, and Imagine360. Eligibility, claims, and some utilization review are handled by the TPA named on the ID card, but access and reimbursement follow Cigna’s rules.

The Haven Detox has treatment centers across the country that work with Cigna every day to ensure high quality care is covered. Our admissions team verifies Cigna benefits up front, explains any costs (like deductibles), and handles any prior authorizations. Any costs are transparent and the process is easy.

Accepts Cigna

Cigna mainly offers exchange and employer plans in Arizona. Most Cigna Arizona plans include mental health and substance-use coverage.

Cigna Employer Plans in Arizona

In Arizona, employers most often choose Open Access Plus for broad national access or LocalPlus for cost savings built with Arizona Care Network for Phoenix and Tucson. For example, the City of Mesa uses Cigna as their health insurance provider with the Open Access Plus plan. ⓘ

Cigna Arizona Commercial Plans

In the 2025 Open Enrollment period, Arizona offered Cigna Marketplace (ACA) plans. Arizona is one of only 11 states where Cigna has a Marketplace presence, which is less states than last year ⓘ. Arizona Exchange plans from Cigna often use EPO/HMO models where staying in-network is important.

The same ACA-compliant plans Cigna sells on the Marketplace can also be purchased directly through Cigna or a broker. They’re the same plan designs and prices, just without subsidy eligibility.

Cigna + Arizona Medicaid

Cigna does not offer or run Medicaid (AHCCCS) in Arizona. If you qualify for AHCCCS (Arizona Medicaid) and also carry a Cigna plan, Arizona Medicaid is the payer of last resort. So, the provider bills Cigna first, then coordinates any remaining eligible amounts with AHCCCS.

Arizona Unique Cigna Coverage Information

Arizona programs often leverage outdoor/experiential therapy (i.e. hiking excursions or adventure-based group therapy). Cigna may cover the service as part of an evidence-based program with licensed clinicians, but pure “desert/adventure therapy” programs or recreational components are excluded.

Accepts Cigna

Cigna offers employer, exchange, and commercial plans in Florida, under Cigna HealthCare of Florida, Inc. Cigna’s mental health & substance use benefits are part of standard coverage.

Cigna has expanded its behavioral health network by nearly 30% in recent years, improving access to both in-person and virtual care across Florida. ⓘ

Cigna Employer Plans in Florida

Cigna states the majority of its health coverage in Florida comes from employer group plans (estimated 75–85%). Florida employers most often choose Open Access Plus (OAP) for broad national access or LocalPlus for cost savings in metro regions such as Tampa, Orlando, and “South Florida”. For example, The City of Miami (as municipal employer) has listed Cigna Open Access Plus (OAP) as a health insurance option for employees. ⓘ

Cigna Florida Commercial Plans

Cigna offers individual & family Exchange plans in Florida through the ACA Marketplace. In 2025, Cigna only lists the following counties as eligible: Broward, Collier, Indian River, Lake, Martin, Miami-Dade, Orange, Osceola, Palm Beach, St. Lucie, and Seminole. (Leon County was removed in 2025). Florida’s Marketplace is run federally through HealthCare.gov, not by a state exchange.

Outside the ACA Marketplace, Cigna also makes the same plans available for purchase directly through Cigna or licensed brokers. These off-exchange commercial plans mirror the Marketplace designs in benefits, networks, and pricing, but do not qualify for federal subsidies. In Florida, this means an individual or family in an eligible county may still enroll in a Cigna plan outside of HealthCare.gov if they prefer to work directly with the insurer or are not eligible for subsidies. ⓘ

Cigna + Florida Medicaid

Cigna does not offer Florida Medicaid managed care plans. Florida’s Medicaid program is overseen by the Agency for Health Care Administration (AHCA) via Statewide Medicaid Managed Care. If you have secondary Cigna and Medicaid coverage, Cigna is billed first for mental health services, with Medicaid covering eligible payments (ie. co-payments).

Florida Unique Cigna Coverage Information

Florida’s Baker Act (psychiatric) and Marchman Act (substance use) allow people in crisis to be admitted for emergency stabilization without waiting for prior authorization. For Cigna members, this means you can enter care immediately in an emergency, and coverage is applied under Cigna’s emergency and parity rules. Continued treatment will require reviews by Cigna.

Accepts Cigna

Cigna’s presence in Massachusetts is limited to employer-sponsored group coverage and ancillary products such as dental and vision.

Massachusetts is one of the most protective states in the country for patients seeking behavioral health services.

Cigna Employer Plans in Massachusetts

Cigna offers a variety of employer plans in Massachusetts, including Open Access Plus (OAP / PPO), LocalPlus (limited network), and a mix of HMO / EPO options. For example, Cigna’s LocalPlus network covers all of Massachusetts but excluding Dukes and Nantucket. Many employers using Cigna add-on wellness programs and funding tools like HSAs, HRAs, and FSAs.

Cigna plans are most common for employers in industries like education, municipal, and health systems. For example, Forward Air, Wesleyan University, and MassMutual are all Massachusetts companies that have publicly listed Cigna as their employer insurance provider.ⓘ

Cigna Massachusetts Exchange Plans

Cigna does not currently sell individual or family medical plans on or off the ACA marketplace exchange in Massachusetts (Massachusetts Health Connector).

Cigna + MassHealth (Massachusetts Medicaid)

Cigna is not a Medicaid managed care provider in Massachusetts. Massachusetts Medicaid (MassHealth) uses its own network of MCOs and behavioral health contractors with more than 2 million Massachusetts residents enrolled last year.

If someone has both a Cigna plan and qualifies for MassHealth (in rare dual-eligibility or transitional cases), claims coordination rules will determine which payer is primary.

Massachusetts Unique Coverage Information

Massachusetts has some of the toughest parity laws in the country. That means Cigna must cover behavioral health care on the same terms as medical and surgical care — no stricter visit limits, no higher copays, and no added barriers. Patients have stronger legal protections in Massachusetts than most other states.

New England providers may integrate care for seasonal affective disorder (SAD) in the winter months. Cigna may cover evidence-based approaches like light therapy, CBT, and psychiatric medication when medically necessary.

Accepts Cigna

Cigna serves New Jersey through employer plans. Mental health and substance use care are included as standard benefits. Cigna does not offer exchange plans in New Jersey or Medicare-related plans anywhere any more.

Cigna Employer Plans in New Jersey

Cigna is only focused in New Jersey on employer group plans. Employers in New Jersey commonly adopt Open Access Plus (OAP) for national access or LocalPlus for lower costs using a tighter NJ network. Goodwill Industries of Greater NY & Northern NJ is a notable local company that listed Cigna as a provider. ⓘ

Cigna New Jersey Exchange Plans

Cigna does not sell ACA individual medical plans on the New Jersey exchange, which is called Get Covered New Jersey. You can only get Cigna medical benefits through an employer plan in New Jersey and most other states.

Coordinating Cigna with NJ FamilyCare Medicaid

Cigna does not operate a New Jersey Medicaid managed care plan. NJ FamilyCare contracts with five MCOs: Aetna Better Health of New Jersey, Fidelis Care (formerly WellCare), Horizon NJ Health, UnitedHealthcare Community Plan, and Wellpoint (formerly Amerigroup New Jersey).

If you have both a Cigna commercial plan and NJ FamilyCare, claims are coordinated under primary-secondary payer rules. Your Cigna plan typically pays first, and NJ FamilyCare may cover eligible remaining amounts. ⓘ

New Jersey Unique Coverage Information

New Jersey’s central location, high-quality centers, and patient-centered laws make it a treatment destination for the Northeast, especially Pennsylvania and New York. Patients cross state lines to access Cigna New Jersey behavioral health providers because the state has a high concentration of detox centers, residential rehabs, and dual diagnosis programs. New Jersey facilities often provide shorter wait times compared to their home state. And, New Jersey laws ensure that patients receive urgent treatment without unnecessary insurance or legal barriers.

Accepts Cigna

Cigna only serves Arkansas through employer group coverage, which usually includes mental health and substance use treatment benefits. Cigna does not offer Medicare-related plans, and it does not sell ACA exchange plans in Arkansas for 2025.

Cigna Employer Plans in Arkansas

All of Cigna’s membership in Arkansas is through employer plans. Notably, the City of Little Rock (municipal employer) lists Cigna as its medical plan provider. ⓘ

Cigna Arkansas Exchange Plans

Cigna does not sell ACA individual medical plans on the Arkansas Health Insurance Marketplace, which is operated through HealthCare.gov.

For 2025, Arkansas residents cannot buy Cigna individual or family health coverage on or off the exchange.

Cigna’s health insurance offerings in the state are limited to employer-sponsored group plans and supplemental coverage such as dental and vision.

Cigna + Arkansas Medicaid

Cigna does not operate a Medicaid managed care plan in Arkansas. The state’s Medicaid program, called ARHOME, contracts with other insurers to deliver coverage.

If you have both Cigna employer insurance and Arkansas Medicaid, claims are coordinated by payer rules: Cigna is billed first, and ARHOME may cover eligible remaining costs such as co-pays or deductibles. ⓘ

Arkansas Unique Coverage Information

Arkansas law has made strides — especially via the Prior Authorization Transparency Act, Act 575’s “Gold Card” exemptions, and Medicaid policies eliminating prior auths for certain MAT drugs. But, the protections are partial: many rules apply only to Medicaid, or only to certain products or providers. When you call a provider in Arkansas, they can help you understand if you need prior authorization and what that might mean for your care timeline.

Accepts Cigna

Cigna has several options for psychiatric benefits verification. You can use the myCigna portal on their website or phone app. Or, use their Cigna behavioral health services number 1-800-926-2273, which is a specific number for mental health and addiction benefits.

A treatment facility can call on your behalf to ensure the right insurance codes are included.

With your consent and policy information, a treatment center can verify your Cigna benefits. No one is notified of this inquiry. It is 100% confidential and protected by HIPAA.

The treatment center calls you back to explain your specific policy, including any costs or pre-authorization requirements.

If Cigna behavioral health pre-authorization is required, the treatment center handles the communication with Cigna directly.

Prior authorization is different from a referral. It’s a pre-check that treatment is appropriate and will be covered by Cigna. The treatment center should handle prior authorization paperwork with Cigna directly.

Cigna requires prior authorization for most high-intensity behavioral health care, including medical detox, residential rehab, and psychiatric hospitalization.

Emergency situations (such as severe withdrawal, suicidal or homicidal behavior, or acute psychosis) can be admitted immediately, but Cigna must be notified within 24–48 hours.

Reviews are conducted every 2–3 days to ensure care stays covered, which is more frequent than most other insurers.

PHP typically also requires pre-authorization and ongoing review, though usually less stringent and frequent. IOP sometimes requires.

Routine outpatient therapy, psychiatric evaluations, or follow-up visits usually do not require prior approval.

Denials are not final. Providers can submit appeals with updated clinical documentation. Cigna allows two levels of internal appeal before a case can be sent for external review.

Urgent appeals are reviewed within 72 hours. If both internal appeals are denied, an independent external review can be requested. A favorable decision requires Cigna to cover treatment.

Yes, if Cigna prior authorization criteria for detox are met. Coverage applies when withdrawal could cause dangerous complications such as seizures, delirium tremens, or unstable vital signs.

Most Cigna plans require prior authorization, and facilities must provide daily updates during detox. In practice, Cigna often approves 3–7 days of detox, with longer stays only if Cigna medical necessity addiction criteria are met and symptoms remain unstable.

Yes. Cigna psychiatric authorization policies cover most FDA-approved drugs for depression, anxiety, bipolar disorder, schizophrenia, ADHD, and addiction treatment. Costs depend on your plan’s drug formulary:

Some medications (like methadone for opioid use disorder) are covered under medical benefits (Part B for Medicare or Cigna medical plans) instead of pharmacy benefits. In addition, Cigna pre-auth mental health treatment guidelines sometimes require a physician’s documentation when prescribing off-label or higher-cost medications (like Vivitrol).

Yes. Eating disorders typically meet Cigna medical necessity addiction and behavioral health criteria and are covered at multiple levels of care:

Cigna requires detailed documentation (BMI, vitals, co-occurring medical complications) to prove medical necessity. Most plans also cover psychiatric medications used for eating disorders, such as SSRIs.

If Cigna denies coverage for continued care, providers can appeal Cigna treatment denial with updated records. This appeals process is most successful when progress notes clearly show why a lower level of care would be unsafe.

Yes, Cigna covers therapy for mental health and substance use conditions. This includes individual, group, and family counseling, as well as sessions with a psychiatrist or other licensed prescriber for medication management. To qualify, a covered diagnosis is required such as depression, anxiety, bipolar disorder, PTSD, or a substance use disorder. Though, you do not need to know the diagnosis before seeking help.

Most modern Cigna plans do not set yearly limits on the number of therapy visits. Instead, coverage depends on medical necessity. If you see an in-network therapist, you’ll usually pay only a copay or coinsurance.

Out-of-network visits may still be covered if you have a PPO plan.

Cigna also covers therapy at different levels of intensity when needed – from weekly outpatient sessions to more structured programs like Intensive Outpatient (IOP) or Partial Hospitalization (PHP). The exact cost and access depend on your specific plan, so the easiest way to know what’s covered for you is to have your benefits verified before starting treatment.

Cigna generally covers family therapy when it’s part of a treatment plan for a member with a covered diagnosis (like a child with depression or a spouse with substance use disorder).

For example, Cigna may approve weekly family sessions as part of residential or outpatient care. But, couples counseling for relationship issues alone (without a clinical diagnosis) is typically not covered.

Patients should check whether the provider is in-network and whether sessions are billed under the identified patient’s diagnosis. The Cigna therapy approval process typically requires documentation that the sessions directly contribute to the patient’s treatment plan.

In 2025, Cigna sold all of its Medicare Advantage, Medicare Supplement (Medigap), Medicare Part D prescription drug plans, and Medicare Special Needs Plans (including D-SNPs).

These plans are now branded as Healthspring and managed by Health Care Service Corporation (HCSC), a Blue Cross Blue Shield carrier.

No Medicare products remain under Cigna.

Emergency stabilization is always covered, even without Cigna psychiatric authorization. This includes ER visits, psychiatric crisis units, and inpatient admissions under state laws like the Baker Act (Florida) or Massachusetts’ involuntary admission protections.

After admission, Cigna reviews the case within 24 hours for medical necessity based on Cigna pre-auth mental health treatment rules. Continued inpatient or residential care requires updated clinical documentation every 2–3 days proving the patient still meets Cigna medical necessity addiction or psychiatric stabilization criteria. Patients should know they cannot be turned away in an emergency.

Patients have several ways to manage costs:

Your information will be kept private

Need someone to talk to? We’re always here—day or night.

Ask questions, get guidance—no pressure, no obligation.

Your story stays with us. Confidential support, always.

There’s no catch. Checking your insurance is simply a way to see what your plan covers — it doesn’t lock you into treatment, notify anyone, or cost you anything. You get answers upfront to decide what makes sense for you.

Protecting your privacy matters! No information or notifications are ever sent to your employer or family — whether you check your insurance online or call. Everything is handled through secure, encrypted systems that meet strict medical privacy laws. You stay in control of your information!

Luckily, most insurance policies cover treatment here. Depending on the healthcare you’ve already had this year, costs could even be zero. Instead of worrying, let’s just find out what your plan covers.

Most likely. We work with major providers like Cigna, Aetna, and United Healthcare, public insurances like Tricare and tribal plans, and even smaller plans like Surest Bind and Harvard Pilgrim. The quickest way to know for sure is to check online or call. It’s a quick, private way to understand what is covered upfront.

Verifying your insurance isn’t a commitment to start treatment — it’s simply a way to see what your options are. Knowing your coverage ahead of time helps you make more informed, confident decisions. It also helps flag a spot, so you’re able to get right in if you ever do decide you’re ready.

You need your policy number to check your specific policy online. If you want general information, just call. You likely have questions beyond insurance anyway. Reaching out now helps you figure out the right fit if or when you’re ready. You don’t have to put off the call until you’re in crisis. Calling is not scary, I promise!